As we prepare to navigate the complex world of medical insurance in the coming year, we’re here to provide an essential resource for understanding the Health Care Provider Plan 2024. Our aim is to equip you with the knowledge to select optimal healthcare coverage options that align with your unique needs, ensuring that you and your family receive the tailored health benefits that foster both wellness and peace of mind.

With health care continuously evolving, it’s more important than ever to fully comprehend the intricacies of your plan. Let us guide you through the Health Care Provider Plan 2024, shedding light on the benefits, the updates from previous years, and the techniques for maximizing your healthcare entitlements.

Key Takeaways

- Comprehensive resource for deciphering the Health Care Provider Plan 2024.

- Insightful tips on selecting the most optimal healthcare coverage options.

- Expert guidance on utilizing tailored health benefits effectively.

- Updated information reflecting the latest evolutions in medical insurance.

- Strategies for ensuring your chosen plan meets personal and family health needs.

- Support for understanding complex healthcare terms and coverage details.

Understanding the Basics of Health Care Provider Plan 2024

As we approach the update to the Health Care Provider Plan 2024, it’s essential for us to understand how the foundation of healthcare services provider plans sets the stage for optimal health management. Customized healthcare plans are becoming the cornerstone of personalized medicine, accommodating the unique health needs of individuals. This evolution reflects the industry’s shift towards innovative health care solutions that emphasize patient-centric care.

Exploring the Key Components of Healthcare Coverage

The typical healthcare coverage is structured to encompass a range of services that cater to preventive, acute, and chronic health needs. To help you navigate these components, we’ve distilled the various elements into an easy-to-understand format:

- Preventative care: Screenings, check-ups, and vaccinations

- Emergency services: Urgent care and emergency room visits

- Treatment services: Hospitalization, surgery, and therapies

- Prescription drugs: Access to essential medications

- Health and wellness programs: Support for maintaining a healthy lifestyle

What Has Changed: The Evolution of Health Plans

In the past year, health plans have seen significant changes, many of which have been driven by advances in technology and a better understanding of individual health needs. For instance, the integration of digital health records and telehealth options has personalized patient experience, enhancing the suitability of customized healthcare plans. Now, more than ever, healthcare solutions are tailored to fit individual preferences and lifestyles.

| Year | Key Feature | Impact on Coverage |

|---|---|---|

| 2023 | Telehealth Expansion | Broader Access to Care Services |

| 2024 | Personalized Health Apps | Customized Health Tracking and Management |

| 2024 | AI-driven Health Insights | Improved Preventative Care and Predictive Analytics |

How to Interpret Your Plan’s Features and Limitations

Understanding your healthcare plan’s features and limitations is critical. While reviewing your benefits, pay special attention to the following:

- The summary of benefits and coverage document

- Annual out-of-pocket maximums and deductible amounts

- Copayment and coinsurance responsibilities

- Coverage exclusions or limitations for specific services

- Network restrictions, including in-network and out-of-network providers

- Policy on pre-existing conditions

Grasping these details will ensure you’re informed and prepared to leverage the advantages of the Health Care Provider Plan 2024 for your health and wellness endeavors.

Selecting the Right Healthcare Coverage Options in 2024

When setting out to compare health insurance plans for the upcoming year, we understand that the wealth of available healthcare coverage options can be overwhelming. Our goal is to streamline the selection process for the best health plans 2024 has to offer by focusing on key decision-making factors. We will walk you through identifying personalized coverage needs, evaluating plan benefits, and ultimately choosing a plan that aligns with your healthcare priorities and budgetary constraints.

- Analyze personal and family healthcare needs, considering any expected changes in the coming year.

- Investigate the full scope of plan coverage details, including preventive services, prescription coverage, and specialist care.

- Observe plan flexibility, such as the ease of seeing out-of-network providers or the need for referrals.

Below is a comparative overview helping you to visually break down the elements you should consider:

| Plan Feature | Importance | Questions to Ask |

|---|---|---|

| Premium Costs | High | What is the monthly premium and how does it fit into my budget? |

| Deductibles | Medium | How much will I need to pay out-of-pocket before coverage kicks in? |

| Copayments and Coinsurance | Medium | What are the copayment amounts for visits and procedures? |

| Prescription Drug Coverage | High | Are my current medications covered and what are the costs associated with them? |

| Choice of Healthcare Providers | Varied | Can I continue seeing my current doctors and are they in-network? |

| Additional Benefits | Low to Medium | Are there services like dental and vision coverage, and are they essential for me? |

In the ever-evolving healthcare landscape, staying informed is paramount. We’re here to assist you in navigating these complex choices to secure suitable healthcare coverage options that meet your needs. Remember, when you compare health insurance plans, you’re investing in your future well-being and peace of mind.

Decoding the Various Types of Medical Insurance Plans

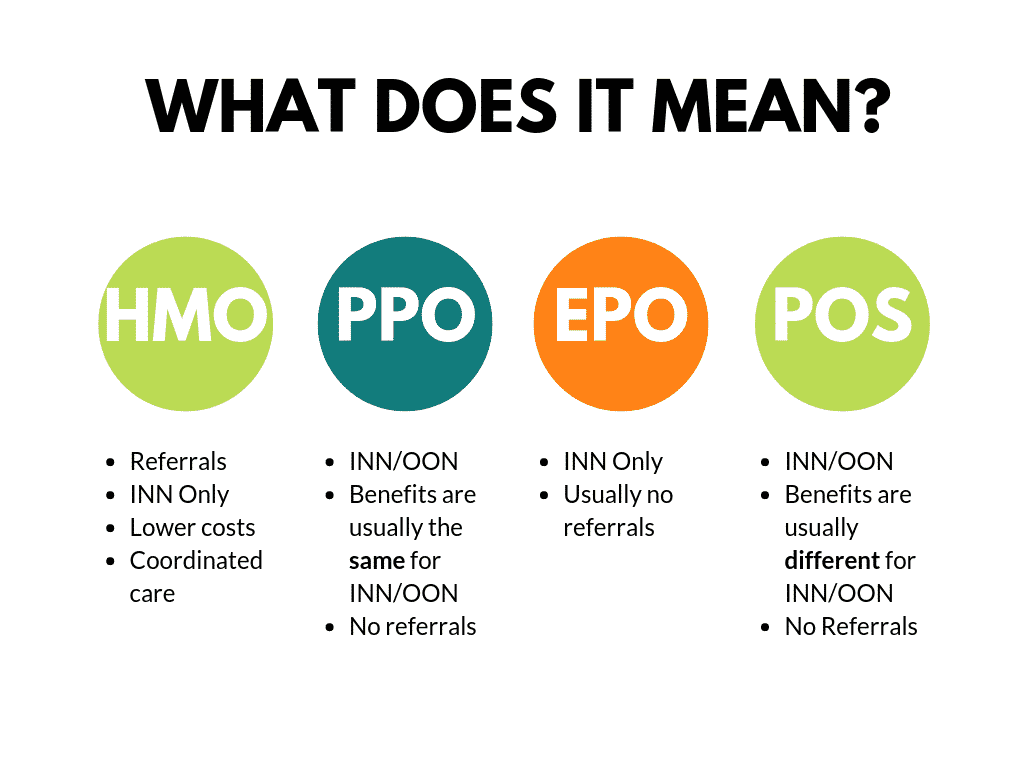

As you step into the complex world of medical insurance, understanding the diversity of plans available is essential. It’s not just about finding any plan but discovering the one that aligns perfectly with your healthcare needs. Let’s delve into the core characteristics of Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans and how they fit into the broad spectrum of provider network options.

Comparing HMOs, PPOs, EPOs, and POS Plans

Each type of medical insurance plan has its unique structure and nuances. HMOs offer a network-savvy, cost-efficient choice, requiring you to select a primary care physician (PCP) and obtain referrals to see specialists. With PPOs, you’ll find flexibility in seeking services both in and out of network, though going outside comes at a higher cost. EPOs combine HMO cost savings and PPO network absence of referral hassles. Lastly, POS plans are a hybrid, offering the cost-saving potential of HMOs while still providing the freedom to see non-network providers like a PPO.

“Choosing a medical insurance plan is more than a financial decision; it’s a lifestyle choice that impacts your access to healthcare services.”

Here’s a quick overview to compare these plans:

| Plan Type | PCP Required? | Referrals for Specialists | Out-of-Network Coverage |

|---|---|---|---|

| HMO | Yes | Yes | Limited or None |

| PPO | No | No | Yes, at higher cost |

| EPO | No | No | Limited |

| POS | Yes | Yes, for out-of-network | Yes |

Aligning Your Needs with the Appropriate Plan Structure

Our health needs and circumstances dictate the plan structure that would serve us best. If you prefer having a consistent doctor manage your care and can commit to staying within a network, an HMO is a solid, cost-efficient choice. If you value flexibility and don’t mind paying extra for it, a PPO allows you to see any healthcare provider. An EPO might be right for you if out-of-network visits are rare but you don’t want the referral requirements like those seen in HMOs. If you’re looking for a middle ground, a POS plan offers that balanced approach, though with some trade-offs in costs and convenience.

- For those who rarely travel: HMOs can be most efficient.

- For those who travel frequently or enjoy greater choice: PPOs offer nationwide coverage.

- For those who value direct access without referrals: EPOs provide a compromise.

- For those looking for flexibility and provider choice: POS plans might be the optimal choice.

Ultimately, our guide aims to illuminate the pathways through the realm of medical insurance plans. Whether it’s a health maintenance organization or another provider network option, the goal is to ensure your choice supports your health and financial well-being flawlessly.

Assessing Comprehensive Health Benefits for You and Your Family

When evaluating comprehensive health benefits, our focus extends to a detailed understanding of plan inclusions that safeguard the well-being of both individual subscribers and their families. Essential to this understanding is the knowledge of preventative care services and the financial implications of out-of-pocket costs. We thoroughly analyze these facets to empower you with information, helping you secure affordable health care options through reliable medical insurance providers.

Understanding Preventative Care Inclusion

Proactive health management begins with preventative care—a cornerstone of comprehensive health benefits. Such services are designed to prevent illnesses before they occur, reducing the need for extensive medical treatment later. Let’s delve into the types of preventative care typically covered and why these services are integral to maintaining lasting health.

Analyzing Out-of-Pocket Costs and Copayment Structures

Understanding the financial responsibilities that come with a health plan is just as important as knowing the medical services covered. Out-of-pocket costs, including co-payments, deductibles, and coinsurance, can significantly affect overall expenses for care. Below we present a comparative analysis of co-payment structures across different plans, aiding you in choosing the most economically efficient path towards well-being.

| Plan Type | Preventative Care Co-Payment | Specialist Visit Co-Payment | Emergency Room Co-Payment | Prescription Drug Co-Payment |

|---|---|---|---|---|

| Basic HMO Plan | $0 | $20 | $150 | $10 |

| Standard PPO Plan | $20 | $30 | $200 | $15 |

| High Deductible Plan | $0* | $40 after deductible | $300 after deductible | $25 after deductible |

| Comprehensive EPO Plan | $0 | $25 | $100 | $10 |

*Preventative care may not be subject to the deductible.

In summary, we recommend carefully reviewing the details of medical coverage, including the fine print regarding preventative care and co-payment expectations. These insights form a critical foundation for selecting medically and financially appropriate health plans. By ensuring that coverage includes vital preventative services and aligns with your budgetary constraints, we guide you towards achieving the peace of mind that comes with secure and affordable health care options.

Maximizing Your Benefits Through the Healthcare Provider Network

When it comes to health coverage, the value of your plan is often tied to the strength and quality of your healthcare provider network. We regard it as one of the most critical aspects to consider when choosing trusted medical coverage plans. The intention is clear: to secure healthcare services from providers who have established a partnership with your insurance company, offering you, the insured, quality services at negotiated rates. Below, we delineate methods to fully harness the potential of your healthcare provider network.

Firstly, understanding the distinction between in-network and out-of-network providers is essential. In-network providers are part of your healthcare provider network and often mean lower out-of-pocket costs for you. On the contrary, seeking services from out-of-network providers frequently leads to higher expenses and extra legwork for reimbursements. Therefore, prioritizing in-network providers ensures you’re leveraging the alliance between your healthcare services provider and insurance plan.

To help manage and navigate your network easily, consider the following checklist:

- Always verify the network status of any provider before making an appointment.

- Review the benefits handbook provided by your insurance; confirm details by contacting customer service.

- Ask your provider directly if they accept your insurance and are considered in-network.

- Understanding specialty referrals within your network can prevent surprise charges.

Beneath, we provide an informative table that compares the benefits of utilizing in-network services versus the potential costs associated with out-of-network care.

| Service Type | In-Network Benefits | Out-of-Network Considerations |

|---|---|---|

| Primary Care Visit | Lower copayments, entire visit often covered after copay | Higher copayments, possibility of paying the full cost upfront |

| Specialist Referral | Costs significantly reduced; referral may not be needed | Referral required, higher chance of full payment, less coverage |

| Laboratory Tests/X-rays | Often fully covered or a minor copay | May result in full charge or high out-of-pocket share |

| Emergency Services | Insurance may cover a larger portion of the cost | Can result in high deductibles and coinsurance payments |

| Prescription Drugs | Generic and brand-name drugs at reduced prices | Limited coverage leading to higher expenses for medications |

Lastly, it is vital to evaluate and understand the breadth of your healthcare services provider network periodically. Doing so ensures continuous access to trusted medical coverage plans that align with both your health requirements and financial considerations. Keep abreast of changes in your network and make informed decisions to maintain optimized benefits from your chosen healthcare provider network.

Customized Healthcare Plans: Adapting to Individual Needs

In our pursuit to cater to each person’s unique health circumstances, we highly emphasize the development of customized healthcare plans. Such plans represent the forefront of personalized medical care, ensuring that everyone—from the young adult managing a new diagnosis to the seasoned senior with multiple chronic conditions—has access to a healthcare services provider that can adapt to their specific health needs and preferences.

Personalization and Flexibility in Healthcare Provision

The concept of personalization within the realm of healthcare services cannot be overstated. It marks a shift away from the one-size-fits-all approach, addressing the distinctive health goals and lifestyle factors of individual patients. Our commitment is to a healthcare landscape where flexibility and tailored healthcare strategies align seamlessly with patient needs to create a framework for sustained well-being and preventive care.

Considerations for Special Populations and Chronic Conditions

When we speak about special populations healthcare, we are referring to a nuanced understanding of groups that require additional resources and care coordination to navigate their health. These populations can include persons with disabilities, the elderly, or those with chronic illnesses that demand ongoing management. For these individuals, a healthcare services provider must offer broader networks of specialists, more frequent touchpoints, and care strategies that evolve alongside the progression of their conditions.

| Health Need Category | Customization Aspect | Benefit Provided |

|---|---|---|

| Chronic Disease Management | Disease-specific care teams and treatment plans | Targeted therapy and coordinated healthcare resources improve patient outcomes |

| Pediatric Care | Child-centric health services and facilities | Optimizes developmental health and provides family-focused support |

| Geriatric Services | Age-appropriate care protocols and accessibility features | Enhances quality of life and independence for older adults |

Building Strong Medical Provider Partnerships in 2024

In the landscape of healthcare coverage options, the significance of a medical provider partnership cannot be understated. By cultivating a solid relationship with your healthcare services provider, you’re investing in a partnership that’s designed to enhance your overall health outcomes. What’s on the horizon in 2024 for these crucial alliances? We’ve noticed several core attributes that fortify these connections, ensuring you receive the patient-centered care you deserve.

We understand that transparency between patients and providers is more than just a buzzword—it’s the foundation of trust. Access to clear information about treatment options, risks, and costs associated with healthcare allows for informed decision-making. To underline the benefits of a robust medical provider partnership, let’s explore some key elements that define successful collaborations:

- Open communication channels that reassure patients of continuous support and clarity on health matters.

- Shared decision-making practices that respect patient autonomy and preferences.

- Regularly assessing and aligning patient goals with treatment plans.

Recognizing the impact of these elements, we’ve constructed a table illustrating the comparative advantages of a strong medical provider partnership in the context of healthcare coverage options:

| Partnership Feature | Benefits | 2024 Outlook |

|---|---|---|

| Enhanced Communication | Improved patient understanding and satisfaction | Increased adoption of telehealth platforms for direct patient-provider communication |

| Shared Decision-Making | Greater patient involvement leads to personalized care | More healthcare services providers adopting patient-centered care models |

| Goal Alignment | Healthcare plans match patient objectives, improving treatment outcomes | Customized healthcare coverage options to support individual health ambitions |

As we look to the horizon, it’s clear that strengthening these partnerships will remain paramount in our pursuit of health and wellbeing. The technology and healthcare landscapes of 2024 are coalescing to support these relationships like never before. Through a dedicated medical provider partnership, you’re empowered to navigate the variety of healthcare coverage options available, ensuring that your journey towards optimal health is a shared endeavor.

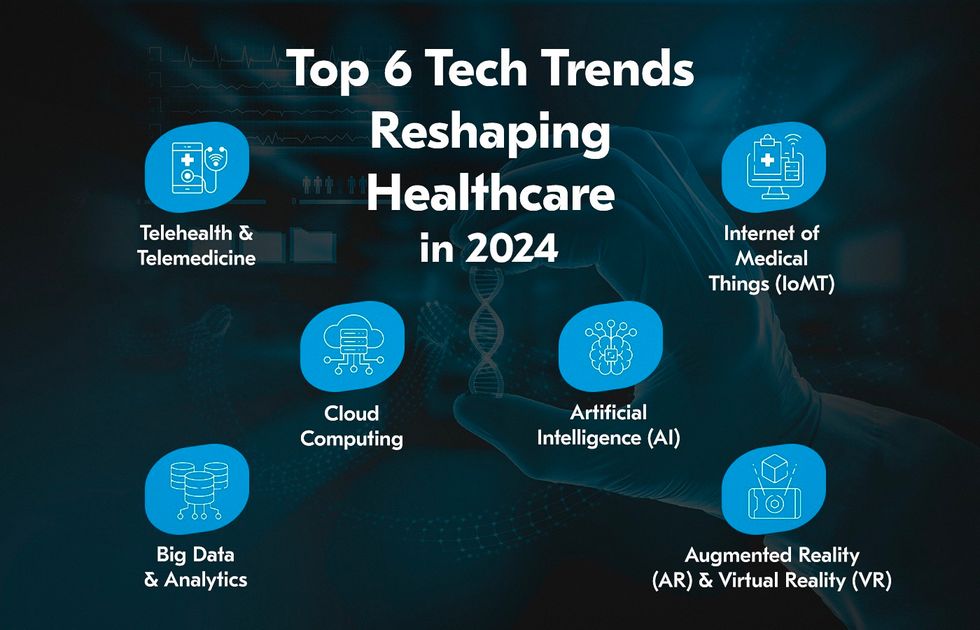

Innovative Health Care Solutions and Trends to Anticipate

As we pave the way for the future of healthcare, our focus in 2024 will center around the continuous evolution and integration of innovative health care solutions. Chief among these advancements are telemedicine services and the comprehensive use of healthcare data analytics that lead to more personalized and effective health care options. With these cutting-edge developments, we stand on the brink of transforming patient experience and healthcare delivery.

The Rise of Telemedicine and Digital Health Tools

Telemedicine has made significant strides, evolving from a novelty to a necessity within the healthcare infrastructure. The accessibility and convenience of remote consultations are unmatched in the digital age, enabling patients to receive care without geographical constraints. Moreover, digital health tools have empowered individuals to keep better track of their health and foster proactive healthcare practices. The integration of these innovations contributes to a more efficient and patient-centered health care ecosystem.

Healthcare Data Analytics and Personalized Medicine Advances

The amalgamation of big data in healthcare has revolutionized the way we understand and treat diseases. With healthcare data analytics providing the backbone for advances in personalized medicine, patients can now receive treatments tailored to their genetic makeup and lifestyle factors. This precise approach not only enhances the effectiveness of treatments but also helps in predicting health trends that preemptively improve patient outcomes.

| Traditional Healthcare | Telemedicine and Digital Health Tools | Healthcare Data Analytics |

|---|---|---|

| Standardized treatment protocols | Access to care regardless of location | Customized patient care plans based on data |

| Manual monitoring of health | Real-time health tracking and management apps | Data-driven decision making and predictive modeling |

| General health advice | Personalized communication with healthcare professionals | Genetic and environmental factor analysis for personalized treatments |

Navigating the Selection of Top Rated Health Insurers

Choosing health insurance is a critical decision that affects both your financial well-being and your access to quality healthcare. As we evaluate the myriad of trusted medical coverage plans, it’s imperative to select top rated health insurers recognized for robust healthcare provider networks. We’re here to guide you through the essential factors to consider, ensuring you make an informed decision that aligns with your health needs and expectations.

Evaluating Insurer Performance and Customer Satisfaction

To discern the performance of health insurers, start by examining industry ratings and customer testimonials, which are indicative of the insurers’ reliability and service quality. Look beyond the numbers; personal experiences shared by current policyholders can give you deeper insights into the responsiveness and support offered by insurers. A top-rated health insurer typically stands out for excellent customer engagement and dispute resolution. In this process, checking third-party review platforms and the National Committee for Quality Assurance (NCQA) ratings can be incredibly helpful.

Transparency and Claims Processing Efficiency

Equally crucial is evaluating the transparency of an insurer regarding policy terms and the efficiency of their claims processing. A trusted medical coverage plan should have clear, understandable policy documentation and a track record for managing claims promptly. Delays or ambiguity in handling claims can be a significant source of stress for policyholders, thereby affecting the overall satisfaction with the healthcare provider network. The table below serves as a comparison framework to assess different insurers on these critical attributes.

| Insurer | Customer Satisfaction Rating | Claims Processing Timeframe | Transparency Level | NCQA Rating |

|---|---|---|---|---|

| Aetna | 4.0/5 | Within 10 business days | High | 4.5/5 |

| Blue Cross Blue Shield | 3.8/5 | Within 15 business days | Moderate | 4.0/5 |

| UnitedHealthcare | 4.2/5 | Within 7 business days | High | 4.5/5 |

| Cigna | 3.5/5 | Within 20 business days | Moderate | 3.5/5 |

| Kaiser Permanente | 4.5/5 | Within 5 business days | Very High | 5/5 |

By taking a meticulous approach to scrutinizing each healthcare provider network and insurer on these criteria, you’ll be better positioned to entrust your health to a company that demonstrates both excellence in service and commitment to policyholder satisfaction. In the dynamic landscape of health insurance, being well-informed is your greatest ally in securing top rated health insurers that promise peace of mind and reliable medical coverage.

Cost vs. Quality: How to Compare Health Insurance Plans

As consumers, when we set out to compare health insurance plans, it’s essential to strike a balance between affordability and the quality of care offered. We understand that finding the best health plans 2024 can seem daunting, especially when considering the financial implications. However, our goal is to ensure you have the tools to evaluate these plans thoroughly, focusing on both costs and benefits for a well-rounded decision. Let’s delve into how to assess affordable health care options that don’t cut corners on your well-being.

Step 1: Identify Your Healthcare Needs – List out any regular prescriptions, anticipated medical procedures, or ongoing healthcare requirements. This information will form the basis of what you require in a health insurance plan.

- Consider the level of care you anticipate needing throughout the year.

- Account for any specialists or particular treatments you may need access to.

Step 2: Review Plan Features – Examine the features that each insurance plan offers, looking beyond the headline figures to understand what’s actually covered.

- Analyze the coverage for preventative care as this can save money in the long run.

- Check the inclusivity of high-demand services like maternity or mental health support.

Step 3: Calculate Total Costs – When examining the cost, don’t just look at the premium. Factor in deductibles, co-pays, and coinsurance to glean a true sense of overall expenses.

| Plan | Monthly Premium | Deductible | Co-pay | Coinsurance | Out-of-Pocket Max |

|---|---|---|---|---|---|

| Plan A | $320 | $1,500 | $30 | 20% | $7,000 |

| Plan B | $280 | $2,000 | $40 | 25% | $6,000 |

Step 4: Evaluate the Provider Network – Ensure the plan’s network is sufficiently comprehensive, incorporating an array of specialists and high-quality facilities.

- Check if your current doctors and preferred hospitals are in-network.

- Assess the network’s range and availability in your area.

Step 5: Review Customer Satisfaction – Research current member insights to gauge the insurer’s reliability and quality of service.

“Extensive research into member experiences can provide valuable clarity on the insurer’s performance and customer service.”

In closing, we understand that financial constraints are a significant concern, but emphasizing quality and comprehensive coverage safeguards not just your health, but also protects against unforeseen expenses. By approaching the process methodically and with enough knowledge, you can confidently select a plan that balances both cost efficiency and quality care—a hallmark of the best health plans for 2024.

Conclusion

As we draw near to the 2024 enrollment period, our collective focus must pivot towards preparation and vigilance. Ensuring that you are thoroughly prepared for enrollment, equipped with knowledge and understanding, is crucial. We, as healthcare consumers, must take assertive steps now to align ourselves with the best medical insurance plans that cater to our unique needs. As you tread through the often complex terrain of healthcare decisions, remember the vital role of healthcare services providers in facilitating optimal outcomes.

Preparing for Enrollment: Steps to Take Now

Begin by reviewing the health care provider plan 2024 and identify any changes or updates from the previous year’s coverage. It’s essential to verify your current information, update personal details if necessary, and reassess your healthcare needs to ensure they align with the offered coverage. This due diligence is the anchor in selecting a plan that will serve you effectively in the coming year.

Maintaining Your Health Coverage: Tips on Staying Informed

Maintaining your health coverage extends beyond the initial enrollment. Stay informed about your plan and its benefits throughout the year. Take advantage of educational resources provided by your healthcare services provider, and don’t hesitate to ask questions when uncertainties arise. It’s by our active engagement and continuous learning that we can safeguard our health investments and embrace a comprehensive understanding of our chosen medical insurance plans.

FAQ

What is the Health Care Provider Plan 2024?

The Health Care Provider Plan 2024 is a comprehensive guide designed to help consumers understand and maximize their healthcare coverage. It outlines the optimal healthcare coverage options available and provides insights into tailored health benefits. This plan is essential for navigating the evolving medical insurance landscape in 2024.

How can I understand the changes in healthcare plans from previous years?

Our resources provide an in-depth analysis of the advancements from previous years. We focus on innovative health care solutions that have been introduced and help you interpret the current features, limitations, or exclusions that are part of your healthcare plan.

What should I consider when selecting healthcare coverage in 2024?

When selecting healthcare coverage for 2024, consider your personal healthcare needs, compare health insurance plans, and assess the benefits provided. Look for the best health plans that align with your requirements and offer comprehensive coverage that is also cost-effective.

What are the differences between HMOs, PPOs, EPOs, and POS plans?

Each type of plan (Health Maintenance Organization, Preferred Provider Organization, Exclusive Provider Organization, and Point of Service) has different pros and cons regarding provider network options, out-of-pocket costs, referrals, and coverage for out-of-network services. We provide detailed comparisons to help you choose the appropriate structure for your needs.

How important are comprehensive health benefits for families?

Comprehensive health benefits are vital for families as they cover preventative care and other essential healthcare services. Understanding the inclusion of these services, along with out-of-pocket costs and copayment structures, is crucial for selecting affordable and adequate health care options from trusted medical insurance providers.

How can I maximize my benefits through the healthcare provider network?

Maximizing benefits involves understanding your plan’s network and ensuring that you access in-network healthcare services providers whenever possible. Utilizing trusted medical coverage plans within the network can significantly reduce costs and improve the overall quality of care.

What are customized healthcare plans and how do they cater to individual needs?

Customized healthcare plans are personalized to fit an individual’s specific health requirements, offering flexibility and specialized care, especially for people with chronic conditions or those requiring special healthcare services. These plans prioritize the adaptation of services to meet unique health challenges.

Why is building a strong medical provider partnership important?

Building a strong partnership with your medical provider enhances communication, trust, and continuity of care, all of which are crucial for achieving optimal health outcomes. A good partnership ensures that your healthcare needs are fully understood and addressed in a collaborative manner.

What innovative health care solutions should I anticipate in 2024?

In 2024, anticipate a rise in telemedicine and the use of digital health tools, as well as advancements in healthcare data analytics that will drive personalized medicine. These solutions aim to make healthcare more accessible, efficient, and tailored to individual patient needs.

How do I evaluate the performance and customer satisfaction of top rated health insurers?

Evaluating top rated health insurers involves researching and comparing customer satisfaction ratings, transparency in policy information, and the efficiency of claims processing. Look for unbiased user reviews, industry rankings, and consumer reports to make an informed decision.

How can I find a balance between cost and quality when comparing health insurance plans?

To balance cost and quality, assess the value of the health plan’s benefits in relation to the premiums, deductibles, and out-of-pocket expenses. Consider not only the affordability but also the extent of coverage and the reputation of the insurer for providing quality care.

What steps should I take now to prepare for enrollment?

To prepare for enrollment, begin by researching available health plans, understanding the eligibility criteria, and gathering any necessary documentation. Also, evaluate your healthcare needs and budget to identify the most appropriate plan options for you or your family.