Tax season can often be a period of stress and confusion, but with the advent of online tax services, the daunting task of filing taxes has been significantly simplified. We at TurboTax have revolutionized tax filing, making it not just accessible, but refreshingly straightforward. Every year, we strive to provide you with an unparalleled experience that not only eases the process but also aims to maximize your tax returns.

Tax filing made easy—that’s our promise to you. Our suite of services is designed with your financial wellbeing in mind, ensuring that you’re educated on every possible deduction and credit to which you’re entitled. So, as we dive into the details, let us guide you through the steps to not just meeting your tax obligations, but exceeding your own financial expectations.

Online tax services like ours are more than just convenience; they’re a catalyst for empowering taxpayers to take control of their finances. Join us as we explore actionable TurboTax tips and provide the invaluable insights you need to navigate this tax season with confidence.

Key Takeaways

- Utilizing TurboTax enhances the tax filing experience, ensuring ease and accessibility.

- Maximizing your tax returns is seamless with our tips and strategically designed tax tools.

- Educating yourself on deductions and credits is key to optimizing your financial outcome.

- Our step-by-step guidance demystifies the process, making online tax filing a breeze.

- With TurboTax, rest assured that your financial data is in expert hands for maximum return potential.

Understanding the Basics of TurboTax

With the time for e-filing taxes rapidly approaching, it’s essential to understand the tools at your disposal. In recent years, TurboTax has emerged as a prominent tax filing solution, acclaimed in numerous tax software reviews for its ease of use and comprehensive features. Let’s delve into the specifics of what TurboTax is, its benefits, and tips for first-time users to navigate the IRS e-file landscape with confidence.

What is TurboTax?

TurboTax, the brainchild of software company Intuit, is a market leader in tax preparation software. Designed to simplify the intricacies of tax laws and regulations, TurboTax offers a seamless e-filing solution that converts complex tax data into straightforward questionnaires personalized for each user. Whether you’re dealing with simple W-2 income or more complex financial circumstances, TurboTax guides you through the preparation process, ensuring compliance with IRS e-file standards.

Benefits of Using Tax Filing Software

The advantages of using tax filing software such as TurboTax are manifold. Users experience significant time savings by avoiding manual calculations and redundant form entries. The user-friendly interface of TurboTax reduces the potential for errors by automating the process and providing real-time support. Additionally, TurboTax guarantees maximum refund potential by identifying applicable deductions and credits tailored to your financial situation. With secure data encryption, filing taxes online also offers peace of mind regarding the safety of your personal information.

Navigating TurboTax for Beginners

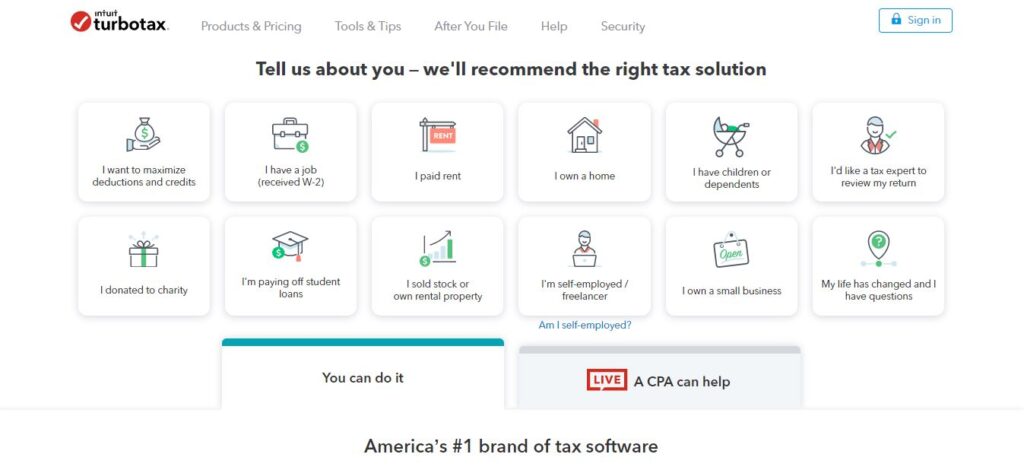

For those new to online tax filing, navigating TurboTax begins with setting up an account. Once that’s in place, TurboTax aids users in seamlessly importing previous tax returns and relevant financial data. The platform features a clean dashboard that indicates progress and highlights necessary actions. Helpful tips and explanations throughout the process make e-filing taxes less daunting, especially with the assurance of error checks and a thorough review before submission.

By embracing TurboTax and its robust tax filing solutions, even beginners can confidently tackle tax season, backed by the expertise of a system designed to align with the IRS e-file protocol and maximize individual returns.

Getting Started With TurboTax

Embarking on the journey of online tax preparation with TurboTax is a smooth process, designed to provide comprehensive tax planning and income tax assistance. We want to ensure that you’re well-equipped to navigate TurboTax’s user-friendly platform with ease. Follow our guide to set up your TurboTax account and commence your tax filing with confidence.

- Create Your Account: Begin by signing up on the TurboTax website. You’ll be asked to provide some basic information such as your name, email, and a secure password.

- Answer Simple Questions: TurboTax personalizes your experience by asking straightforward questions about your life that affect your tax situation.

- Gather Your Documents: Before you proceed, ensure you have all necessary documentation, such as W-2s, 1099s, and other income statements.

Let’s dive into the details of what information you need to have on hand for efficient tax filing:

| Document Type | Description | Importance |

|---|---|---|

| Personal Information | Your Social Security Number or Tax ID, as well as personal information for any dependents. | Crucial for accurate tax filing and to prevent delays with the IRS. |

| Income Statements | All forms of income documentation, including W-2s and 1099s, to report earnings accurately. | Essential to calculate the correct amount of tax owed or refund due. |

| Deduction Documents | Records of deductible expenses such as educational expenses, medical bills, or charitable donations. | Enables you to claim eligible deductions and maximize your refund. |

With TurboTax, rest assured, tax planning becomes significantly streamlined. As you enter your details, the software automatically searches for more than 350 tax deductions and credits to ensure you get the biggest refund possible. Remember, we’re here to offer income tax assistance every step of the way, making online tax preparation a breeze for you.

Maximizing Deductions and Credits

When the tax season approaches, it’s crucial to understand how to leverage tax deductions and credits to maximize tax returns. With TurboTax, we can streamline this process, ensuring you capture all eligible financial opportunities. Let’s delve into the strategies that can boost your tax savings.

How to Identify Eligible Tax Deductions

Firstly, we look for common expenses that can lower your taxable income. To ensure you’re not missing out on any deductions, TurboTax prompts you with questions tailored to your specific situation—whether it’s mortgage interest, charitable contributions, or education expenses. Keep those receipts, as they are your ticket to potentially lowering your tax bill.

- Mortgage Interest

- State and Local Taxes

- Charitable Contributions

- Medical and Dental Expenses

- Education Expenses

Understanding Tax Credits vs Deductions

While both deductions and credits lower your tax obligation, they work differently. Tax deductions reduce the amount of your income that’s subject to taxes, potentially placing you in a lower tax bracket. Tax credits, however, are subtracted from your actual tax liability, which can lead to substantial savings. For example, the Child Tax Credit is directly subtracted from taxes owed, providing more benefit than a simple deduction.

| Deductions | Credits |

|---|---|

| Lower taxable income | Reduce taxes owed dollar-for-dollar |

| Dependent on tax bracket | Same monetary value for all qualifying |

| Subject to limits | May be refundable or nonrefundable |

Tailoring Deductions to Your Filing Status

Your filing status plays a pivotal role in determining which deductions and credits you’re eligible for. With TurboTax, customizing these based on whether you’re single, married filing jointly, or head of household is simplified. It ensures you obtain the optimal tax scenario unique to your life circumstances. Let’s use TurboTax’s guided experience to uncover specific deductions like the Earned Income Tax Credit or education-related credits, each designed to boost your tax efficiency.

- Single filers: Check for personal deductions

- Married filing jointly: Combine deductions with spouse

- Head of Household: Look into credits for dependents

Together, let’s navigate the plethora of tax deductions and credits available, ensuring we maximize tax returns with TurboTax. Gathering documentation and understanding these tax benefits are the first steps toward an optimized tax outcome.

Evaluating Your Tax Filing Status

As we navigate the complexities of tax planning, it’s imperative to understand the significance of selecting the correct tax filing status. It directly influences the amount of your standard deduction, the credits you’re eligible for, and ultimately, your tax liability. To demystify this process, we’ll dissect the differences between the most common filing statuses and leverage tools like TurboTax’s intuitive tax refund calculator to forecast outcomes. Here’s how each scenario could apply to you.

Single, Married, Head of Household: What’s the Difference?

Each tax filing status carries with it its own set of rules and potential benefits. For instance, single filers are subject to standard deduction amounts and tax rates tailored to individuals without a spouse, whereas married filers have the choice to file jointly or separately, each option offering distinct advantages based on combined income and deductions. Meanwhile, the head of household status is designed for unmarried individuals who support dependents, providing greater deduction rates and more favorable tax brackets.

Impact of Dependents on Your Tax Returns

Dependents don’t just add joy to families—they also bring financial impacts to your taxes. Claiming a dependent can open doors to credits such as the Child Tax Credit and can significantly impact the earned income credit. With the assistance of tools like TurboTax, navigating these impacts becomes simpler. The platform incorporates questions about dependents directly into the tax return process to ensure you’re capturing all relevant tax benefits.

Why Your Filing Status Matters

Your tax filing status does not just define how much you pay; it’s a cornerstone of tax planning. It affects income thresholds for deductions and credits, tax rates, and the potential to receive a larger refund. The right status could mean the difference between owing the IRS and securing a favorable return. A good strategy is to employ a tax refund calculator early in the year to estimate your tax responsibilities and plan accordingly. *TurboTax* offers year-round planning tools to make sure when tax season arrives, you’re ready to file efficiently and accurately.

Turbotax’s Tax Refund Calculator

As we navigate through tax season, many of us are looking for reliable tax filing solutions that can provide accurate insights into our financial obligations or returns. TurboTax, a prominent figure in online tax services, offers a powerful tax refund calculator that stands as an indispensable tool for those seeking to estimate their tax situation. Let’s explore how this calculator simplifies the process of predicting your tax refund or determining the amount you may owe to the IRS.

The tax refund calculator by TurboTax requires some basic information to get started. This includes your filing status, income details, and any deductions or credits you plan to claim. Using this data, the calculator then provides an estimation of your tax refund or the tax liability. It’s essential to have your financial information on hand for the most accurate estimate.

“TurboTax’s tax refund calculator gives you a snapshot of your fiscal health, allowing you to plan your finances with greater confidence.”

Why is this calculator tool crucial for your financial planning? By having a clearer picture of where you stand before filing, you can make informed decisions on possible deductions and strategize accordingly. Perhaps you may decide to contribute more to retirement funds or adjust withholdings from your paycheck if you owe taxes.

| Feature | Benefit |

|---|---|

| User-Friendly Interface | Makes it simple for anyone to enter their information and receive an estimate quickly. |

| Detailed Breakdown | Provides insights into how different inputs like deductions can affect your refund or tax due. |

| Updated Tax Laws | Ensures calculations reflect the latest tax laws and credits. |

| Guidance Tips | Offers tips to maximize your refund and optimize financial planning for the year. |

We understand the importance of accurate tax calculation, and with TurboTax’s tax refund calculator, users gain a trusted ally in managing their taxes. It not only serves as a preliminary assessment but also guides your approach to tax filing, highlighting why TurboTax is considered a leader in online tax services.

Common Mistakes to Avoid in Tax Preparation Online

As we steer through the complexities of online tax preparation, our goal is to equip you with the knowledge to sidestep typical tax filing mistakes. By utilizing TurboTax, you not only gain access to comprehensive income tax assistance, but also a platform designed to minimize errors that can lead to setbacks when filing your taxes. Below, we break down some of the most common blunders and how to prevent them.

- Incorrect Personal Information: Ensure every detail, from your Social Security number to your birth date, is entered correctly. A minor typo can result in processing delays or, worse, your tax return ending up in the wrong hands.

- Omitting Income Sources: All income, regardless of size or source, should be reported. TurboTax assists in organizing various sources of income, including freelance earnings, investments, and even small gig work, to keep your records thorough and precise.

- Overlooking Deductions and Credits: Don’t miss out on valuable deductions and tax credits. TurboTax prompts you to check for potential benefits that you may qualify for, such as educational credits or deductions for charitable contributions.

- Not Understanding Tax Law Changes: Tax laws evolve, and being uninformed can cost you. Stay updated with TurboTax’s guidance on new tax regulations to ensure your filings align with the latest laws.

| Mistake | Potential Consequences | How TurboTax Helps |

|---|---|---|

| Incorrect Personal Info | Delayed refund, IRS notices | Double-checks entries for errors |

| Missing Income | Underreporting, penalties | Categorizes all income streams |

| Oversights on Deductions/Credits | Higher tax liability | Identifies possible deductions |

| Outdated Tax Knowledge | Non-compliance with tax laws | Updates on law changes and implications |

Remember, a careful review of your tax return before submission can prevent these common pitfalls. With TurboTax, you’re not just using a tool; you’re adopting a proactive approach towards error-free online tax preparation. Handling your taxes doesn’t have to be daunting—let TurboTax guide you to a smooth and stress-free filing experience.

Utilizing TurboTax for Self-Employed Individuals

For the entrepreneurial spirits who forge their own path as freelancers, contractors, or sole proprietors, managing taxes can be a unique challenge. We understand the intricacies of tax filing for self-employed individuals, and that’s where TurboTax enters the picture. Its intuitive design helps to maximize your tax returns through diligent tax planning and identifying potential tax deductions.

Tracking Expenses and Deductions

Keeping a meticulous record of business-related expenses is critical for self-employed professionals. TurboTax simplifies this by providing an easy-to-use platform where you can track your expenses and categorize them throughout the year. Let’s not let any tax deductions slip through the cracks. By taking advantage of the deductions specific to self-employment, such as home office expenses, travel costs, and necessary supplies, TurboTax ensures that your hard-earned money is accounted for during tax time.

Quarterly Taxes and TurboTax

Unlike traditional employees, self-employed individuals are responsible for paying quarterly taxes. TurboTax offers a comprehensive guide to help calculate how much you owe each quarter, effortlessly integrating this crucial aspect of tax planning into your schedule. We relieve the stress from tax deadlines and aid in preventing any underpayment penalties.

Tax Planning Strategies for Freelancers and Contractors

Our forward-thinking approach includes advising you on how to leverage tax planning strategies unique to your self-employment status. With TurboTax, you have access to industry-specific deductions and can adjust your business expenses to optimize your tax outcomes. It’s all about looking beyond the current year and strategizing for long-term fiscal health.

| Deduction Category | Common Deductions | How TurboTax Helps |

|---|---|---|

| Home Office | Rent, utilities, home insurance | Calculates percentage of home used for business |

| Travel | Mileage, lodging, meals | Tracks mileage with mobile app and logs expenses |

| Supplies | Office supplies, software subscriptions | Organizes receipts and separates personal from business expenses |

| Professional Services | Legal fees, accounting services | Identifies potential deductions in these services |

| Education | Workshops, classes, books | Helps determine if educational expenses are deductible |

In the spirit of tax planning, we ensure that you’re not simply reacting to tax season, but actively preparing for it with the right tools. With TurboTax’s online tax services, our collective aim is to make tax filing for self-employed professionals a seamless and beneficial experience every year. As we navigate the complexities together, rest assured, you won’t be leaving money on the table.

TurboTax and Investment Income

When it comes to managing investment income, TurboTax stands out as an essential online tax preparation tool. Navigating the complexities of capital gains, stock trades, and rental property income is no small task, but our user-friendly platform ensures that your tax returns accurately reflect your investment activities. Let’s explore how we can help you report and optimize your investment income with ease.

Reporting Stock Trades and Dividends

We understand that tracking investment income through stock trades and dividends can be intricate. With TurboTax, you’re guided through a step-by-step process to report this type of income accurately. The platform is designed to import your trading data directly from numerous brokers, saving you time and reducing errors.

Handling Rental Property Income in TurboTax

Rental property income is another area where TurboTax shines. Whether you’re a seasoned landlord or new to real estate investment, our tools simplify declaring this income stream. TurboTax ensures you claim all the deductible expenses associated with your rental properties, optimizing your tax outcomes.

Capital Gains and How TurboTax Can Help

Capital gains tax can significantly affect your investment returns. Our platform includes specific tools tailored for different types of investments, enabling you to calculate both short-term and long-term capital gains. With TurboTax, you’ll have insights into how each transaction impacts your tax liability.

| Investment Type | TurboTax Feature | Benefit to You |

|---|---|---|

| Stock Trades | Direct Broker Import | Automates entry of trades to ensure accuracy and save time |

| Dividends | Dividend Income Reporting | Helps identify qualified dividends for favorable tax treatment |

| Rental Property | Rental Property Deductions Advisor | Advises you on eligible deductions to maximize tax savings |

| Capital Gains | Capital Gains Tax Calculator | Provides clarity on potential taxes owed on investment profits |

With TurboTax by your side, you can confidently manage your investment income and capitalize on capital gains strategies. We’re dedicated to making online tax preparation a smooth and stress-free experience for our users, so they can focus on growing their investments rather than being overwhelmed by tax complexities.

Conclusion

As we draw this guide to a close, we reaffirm the substantial benefits of leveraging TurboTax to maximize tax returns and streamline the e-filing process. The intuitive design and user-centric functionality of TurboTax empower you to take command of your taxes like never before. By embracing this powerful tool, we have illuminated the pathways to demystifying tax deductions and credits, ensuring you don’t leave money on the table during tax season.

Throughout this journey, we’ve dissected how TurboTax makes tax preparation less taxing and demonstrated how it can enhance your financial outcomes. From understanding the basics to deciphering the complexities of investment income, TurboTax serves as a beacon, guiding you towards optimized tax strategies. With its sophisticated features, built to accommodate the varied needs of taxpayers, the platform upholds accuracy and facilitates a smoother sail through the intricate seas of tax laws.

Embarking on the tax preparation adventure with TurboTax at your side can transform what is often an arduous task into an informed experience, ultimately aiming to bolster your financial prosperity. As authors of your tax narrative, we encourage you to harness the insights and tips provided, arming yourselves with the knowledge to adeptly navigate the tax landscape. Here’s to a future of efficient, fortified, and successful tax filings with TurboTax.

FAQ

What is TurboTax and how can it help maximize my tax returns?

TurboTax is a leading tax preparation online software designed to simplify the filing process. It guides users step-by-step through their tax return, ensuring they take advantage of all eligible deductions and tax credits to maximize their returns.

What are the benefits of using tax filing software like TurboTax?

The benefits include time-saving features, a user-friendly interface, expert guidance, and the ability to e-file directly with the IRS, which often results in faster refunds.

Can TurboTax assist beginners with tax preparation?

Absolutely, TurboTax has a number of resources and support options designed to help beginners understand tax laws and guide them through the tax preparation process with confidence.

How do I get started with TurboTax?

You begin by creating an account on the TurboTax website. From there, TurboTax will ask you simple questions to personalize your experience and ensure you provide all the necessary information for your tax situation.

What’s the difference between tax deductions and tax credits?

Tax deductions reduce your taxable income, potentially lowering your tax liability, while tax credits directly decrease the amount of tax you owe, dollar for dollar. Both can significantly impact your tax returns.

Why is it important to choose the correct tax filing status?

Your tax filing status affects the tax rate, the standard deduction amount you qualify for, and your eligibility for certain tax credits, which all influence the overall tax you’ll owe or the refund you’ll receive.

How does TurboTax’s Tax Refund Calculator work?

The tax refund calculator is an online tool provided by TurboTax that estimates your tax liability or refund based on the information you enter about your income, deductions, and credits.

What are common tax filing mistakes to avoid with online tax preparation?

Some common mistakes include entering incorrect personal information, overlooking income sources, and misunderstanding new tax laws. TurboTax provides tools and checks to help avoid these errors.

How does TurboTax cater to self-employed individuals?

TurboTax offers a version specifically designed for self-employed users, which includes features for tracking expenses, handling quarterly taxes, and optimizing self-employment tax deductions and credits.

Can TurboTax handle investment income and capital gains?

Yes, TurboTax has specialized features that help users accurately report investment income, including stock trades, dividends, rental property income, and capital gains, making complex investment tax issues simpler to manage.